If parents are getting divorced or are already divorced, and if one of them lives outside Quebec, then the rules explained in this article usually apply to calculate the amount of the child support.

Child Support Tables

The parent who does not have custody must pay child support to the other parent to cover the children’s needs.

The amount of the child support this parent must pay depends on these factors:

- where the paying parent lives

- the number of children

- the parent’s income

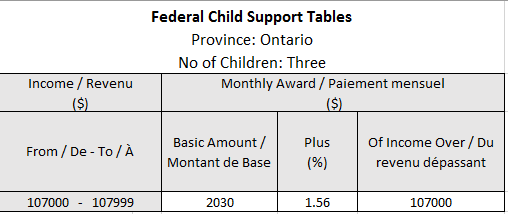

A parent can look at the Federal Child Support Tables to figure out the amount of the support payments. These tables give the basic amounts that apply in each province and territory.

Which table should you use?

Usually, the province or territory where the paying parent lives determines which table applies.

|

Example – Parents Living in Two Different Provinces The parents are divorced. The father lives in Quebec with his two children. The mother lives in British Columbia. Paying parent: the mother, because she does not have custody of the children |

If the paying parent lives outside Canada, then the table to use is the one for the province or territory of the parent receiving the support payments.

|

Example – One Parent in Quebec and the Other Outside Canada The parents are getting a divorce. The father lives in Quebec with his two children. The mother lives in France. Paying parent: the mother, because she does not have custody of the children |

Number of Children

The amount of the child support depends on the number of children who need support.

|

Example 1 The father lives in Quebec with his child. The mother lives in Alberta. Her income is $60,000. Paying parent: the mother, because she does not have custody of the child Amount of support payments: $505 per month Example 2 The father lives in Quebec with his two children. The mother lives in Alberta. Her income is $60,000. Paying parent: the mother, because she does not have custody of the children Amount of support payments: $869 per month |

Income Considered for Calculating Support Payments

The pre-tax income of the parent who does not have custody is used to calculate the amount of child support. Pre-tax income appears on line 150 (“Total income”) of the paying parent’s federal income tax return.

The paying parent is allowed to subtract from total income certain amounts listed in Schedule III.

If the paying parent lives outside Canada, the income will be evaluated as if this parent still lived in Canada. Some adjustments can be made if the tax rates are much higher in that country.

Tax Return Different Than Reality

Sometimes the total income reported in the paying parent’s tax return is not equal to that parent’s real income. This can happen if the paying parent works “under the table” (does not report all income).

Therefore, the parent who has custody can ask a judge to determine the paying parent’s actual income.

Calculating the Amount of Support

You can find out the amount of the support payments if you know the income of the paying parent, the number of children, and which table to use.

|

Example The parents are getting divorced. The father lives with his three children in Quebec, and the mother lives in Ontario. The mother’s income is $107,500. Paying parent: the mother Basic amount for this income bracket: $2,030 However, the mother earns $107,000, not $107,500. An adjustment will have to be made for the difference between these amounts. The adjustment is based on a specific percentage for this income bracket. Percentage that applies to adjustment for this income bracket: 1.56% Income over $107,000: $107,500 – $107,000 = $500 Income over $107,000: $107,500 – $107,000 = $500 Basic amount PLUS 1.54% of income over $107,000: $2,030 + $7.80 = $2,037.80

|

Shared Custody of Children

In a shared custody arrangement, each parent has the children between 40% and 60% of the time.

When parents share custody, child support payments are calculated based on these factors:

- the amount of child support each parent would have to pay as a paying parent under the Child Support Tables

- the higher costs involved in shared custody

- the needs of the children and the parents’ ability to pay

Divorce: Vocabulary Change in the LawSince March 1, 2021, the Divorce Act no longer uses the terms “custody” or “access”. The law now uses the term “parenting time” to describe a divorced parent’s relationship with a child of the marriage. For more information, see our article Divorce: What Is “Parenting Time” and What to Do When Moving. |

Special Expenses

Some expenses must be calculated separately because they are not included in the basic support payments provided in the federal tables. They are called “special expenses”. They are divided between the parents in proportion to their incomes.

These are examples of special expenses:

- child-care expenses

- medical and dental insurance premiums

- expenses for education after high school

- out-of-the-ordinary expenses for extracurricular activities

- health-related expenses

- out-of-the-ordinary expenses for elementary or high-school education or other educational programs