In 1995, the Quebec government passed a law called An Act to facilitate the payment of support. It gives Revenu Québec the power to make sure child and spousal support payments are made. Also, Revenu Québec acts as a go-between for the person who makes support payments and the person who receives them.

|

Here is how it works:

|

Revenu Québec’s Role

Except for people who fall into one of the exceptions mentioned in the law, Revenu Québec gets involved automatically when someone has to make support payments for an ex-spouse or a child under

- a court decision, or

- an agreement approved by a special court clerk or a judge.

The court clerk sends a copy of the court decision or agreement to Revenu Québec, which opens a file and contacts both the payer and recipient of support.

How Support Payments Are Made

Revenu Québec decides whether support will be paid as

- a deduction at source,

- a payment order (explained below), or

- as both a deduction at source and a payment order.

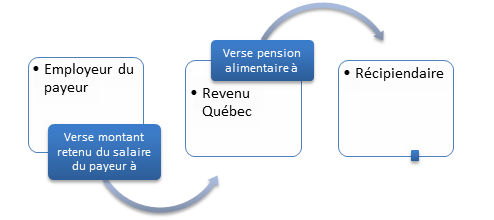

Deductions at Source (applies to employees, for example)

Revenu Québec usually takes these steps:

- contacts the employer of the payer of support

- orders the employer to subtract from the payer’s salary enough money to cover the support payments (this is called a “deduction at source”)

- makes sure the employer sends this money to Revenu Québec

Then, Revenu Québec sends the support payments to the recipient of the support.

A deduction at source can also be taken from other income belonging to the payer of support, for example:

- retirement benefits and severance pay

- employment insurance benefits

- disability benefits

- pay advances

- amounts paid under a profit-sharing plan

If the amount deducted at source doesn’t cover the support payments, the difference is collected through a payment order.

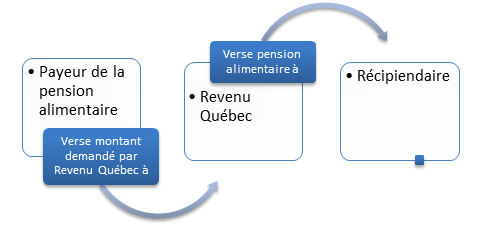

Payment Orders (applies to self-employed workers, for example)

A payment order is a letter that Revenu Québec sends to the payer of support. A remittance slip is sent together with the letter. The letter says how much must be paid to Revenu Québec and how often this amount must be paid.

The payer of support sends the payment to Revenu Québec. Revenu Québec then sends it to the recipient of support.

In some cases, the person who has received a payment order must also provide a guarantee, called “security”. The security must be equal to

- one month of support, or

- the amount Revenu Québec is claiming in order to complete the amount collected through deductions at source.

Revenu Québec Pays Out the Support

Revenu Québec pays support to the recipient of support by cheque or direct deposit twice a month, on the 1st and the 16th of each month.

What Revenu Québec Can Do in Support Cases

Revenu Québec has these powers, among others:

- contact the employer of the payer of support

- manage support payments

- collect support payments

- pay support to the recipient of support

- do whatever is needed to collect support if it hasn’t been paid

Examples:- take legal action against the payer of support

- put a legal claim on this person’s property, seize and sell it

- use this person’s tax refund to make the support payments

- claim extra fees if a person has skipped support payments

- advance money to the recipient of support until the support has been paid

- claim the amount of money that was advanced

- enter into an agreement with the payer of support

Stopping Support Payments

What happens if the payer of support becomes unemployed or earns less?

Revenu Québec does not have the power to do these things:

- make a decision to stop collecting support payments

- change the amount of the support payments

- cancel the support payments

However, you can agree with the other parent to change the amount of child support you are paying according to the applicable rules and your new financial situation. You can than have your agreement approved by a special court clerk. After approval (called “homologation”), the agreement has the same value as a court decision.

To make things easier, you can use the Homologation Assistance Service offered in legal aid offices. A lawyer will prepare all the necessary documents and mail them to the special clerk. Then, the court decision is sent to Revenu Québec. For more information about this service, you can contact the Commission des services juridiques, the organization that runs legal aid.

If no agreement can be reached with the other parent, the person paying support can contact Revenu Québec and then go to court to ask for the support payments to be changed or cancelled.

You can also request a change online using the SARPA service (Service administratif de rajustement des pensions alimentaires pour enfants). The service lets you change a final or temporary court decision that set or approved support payments for a child under 18 years old, all without going back to court. Revenu Québec is notified about the change and will adjust the collection of child support as a result.

Disagreements With Revenu Québec

Depending on the type of decision Revenu Québec has taken, the decision can be challenged in two ways:

- making a request using the form “Notice of Contestation” (PPA-120-V)

- going to court

|

Example of when to file a request using the form:

Example of when to go to court:

|